Collector Car Market Shifts: Monterey 2022

The November issue of Sports Car Market arrived this week, and in it was the reporting on the Monterey Collector Car events and auctions that took place in August. This was the first August since 2019 that wasn't under the dark cloud of COVID. As expected, the attendance demonstrated a lot of pent up demand to get out of the house and go somewhere, and to buy and sell collector cars.

Many records were broken which demonstrated shifts in the collector car market. Multiple world records were realized, mostly with relatively recently built exotica. In all, over 1,000 cars were offered live over the Monterey Collector Car Week realizing over $467M - an advance of $3M over the 2014 record.

The live auctions themselves are changing, no doubt due to the popularity of on-line auctions such as Bring-A-Trailer. Bring-A-Trailer has a $99 listing fee and a 5% buyers fee to a maximum of $5,000. Live auctions typically have a 8-10% sellers fee and a 10-12% buyers fee, and the seller has to pay for the transport to the auction (and duty if not in the US). With the Spyker we just sold, the buyer paid just $5k and we retained 100% of the auction amount. If this car were sold in Monterey the fees would total more than $USD70,000!

To be competitive, the live auctions are going up market. RM's average sale price in Monterey this year was $1,289,488. Granted, many of the 'big' cars have stayed away during COVID and have emerged at once, but this is more than double what it used to be.

The other thing that the live auctions are trying to do is leverage the glamour of their proceedings and transform the auctions into 'lifestyle' events.

Barrett Jackson - already a circus - sold a 55% interest in the company to IMG who runs the UFC and New York Fashion Week. IMG bills themselves as, "a leading independent producer and distributor of sports and entertainment media".

Several executives from RM Sothebys quit and started their own auction company, Broad Arrow. This attracted the attention of Hagerty, who after a public offering, is making acquisitions to transform themselves into a 'lifestyle' brand. Hagerty bought the start up before they even had their first auction, valuing it at $80M. Broad Arrow took over the McCall Jet Center event which has historically brought together big dollar collector cars with executive jets along with some vintage aircraft. Hagerty also bought the Amelia Island Concours.

What used to be just an auction is now turning into influencer-filled party with a live stream. I suppose this is the future, but I'm hoping that David Gooding keeps his auctions the way they are...

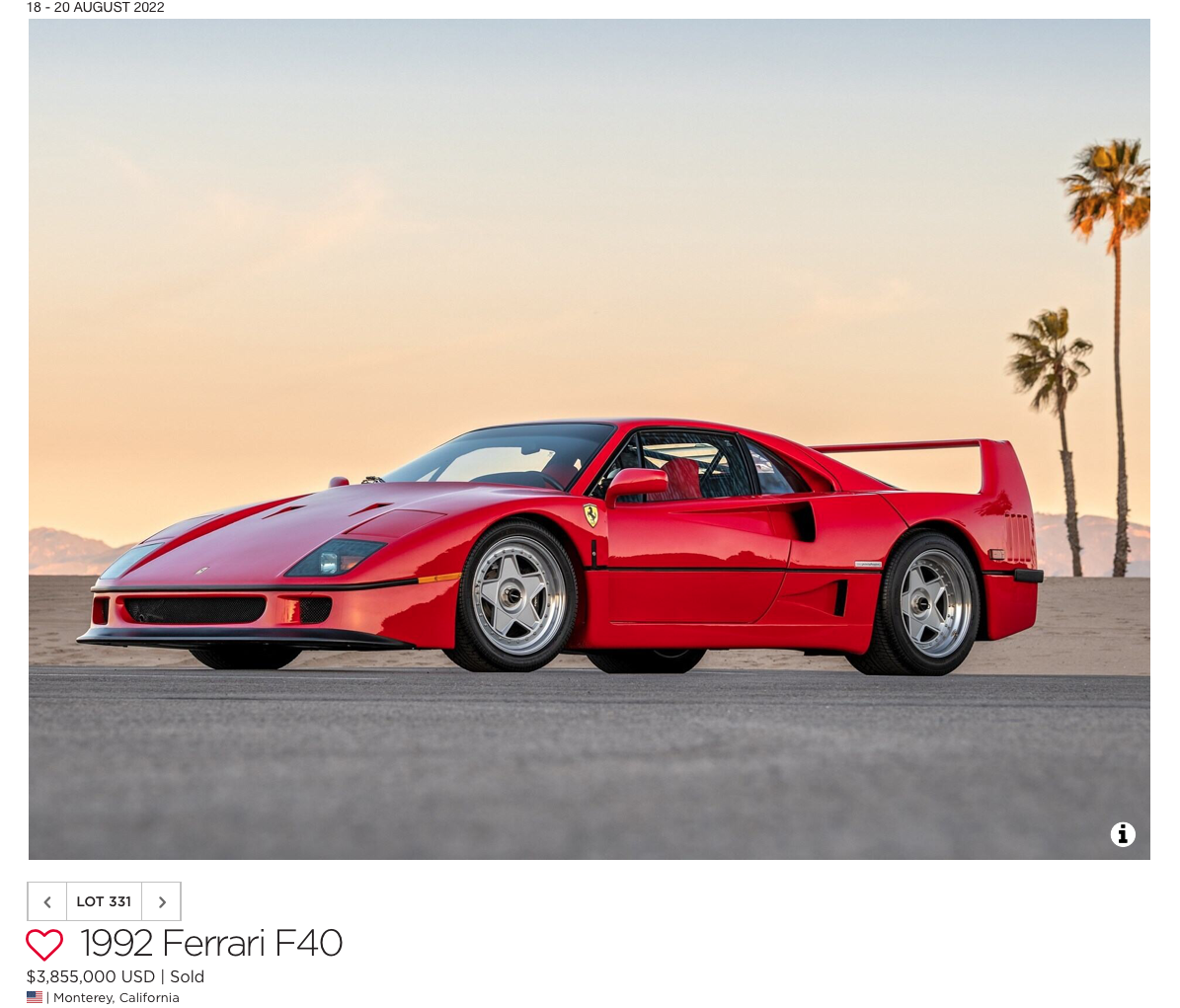

The collector demographics have continued to change and to favour relatively new cars. Most of the record prices in Monterey this year were for relatively recent exotica: $5.175M for a Ferrari F50, $3.855M for a F40, $1.875 for a Porsche 959 Komfort and $1.6M for an Lexus LFA Nurburgring.

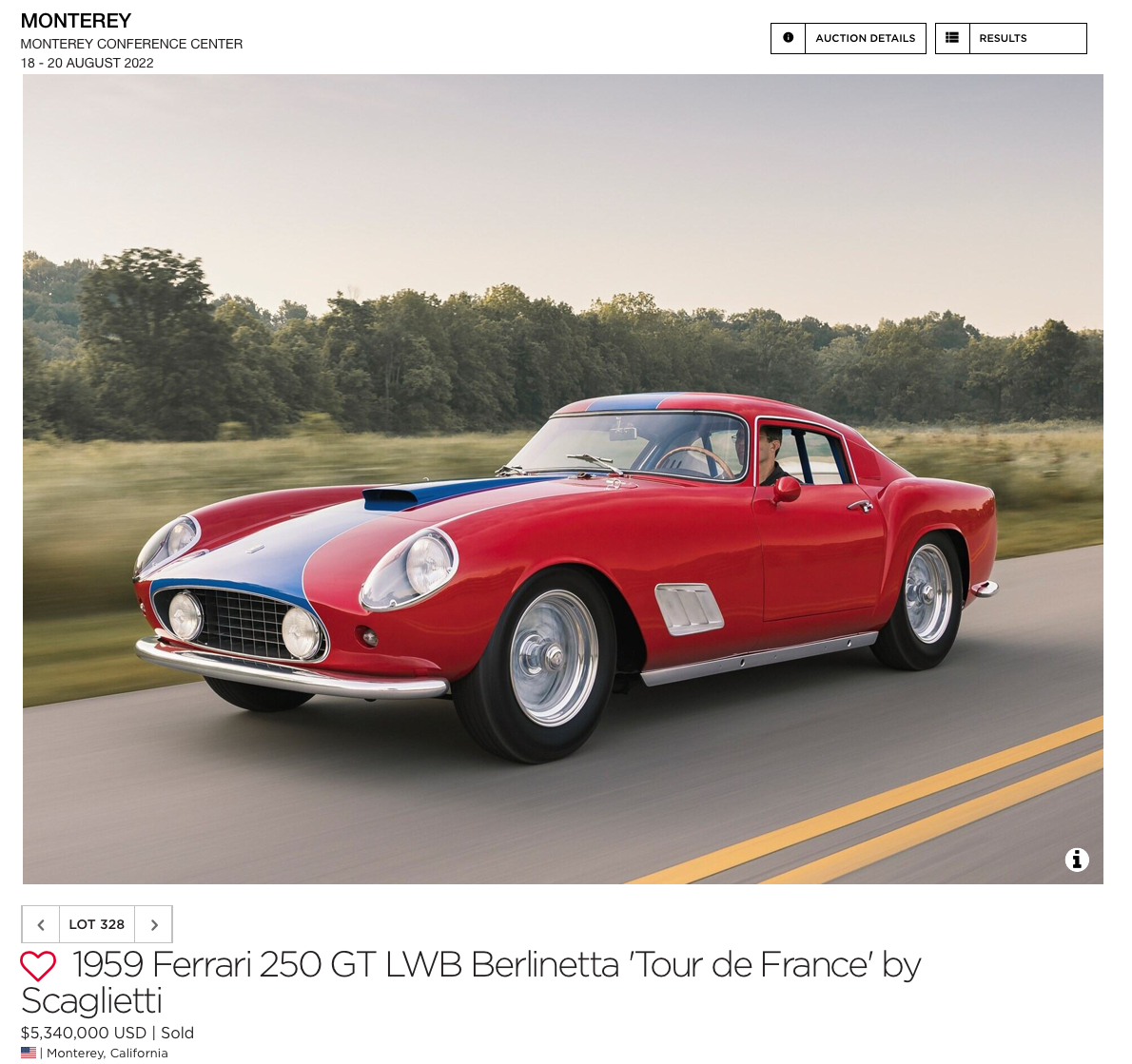

RM sold a 1959 Ferrari 250 Tour de France for $5.34M. This was one of 77 TDF's, and a genuine competition Ferrari. Broad Arrow got roughly the same number ($5.175M) for a 1 of 349 Ferrari F50.

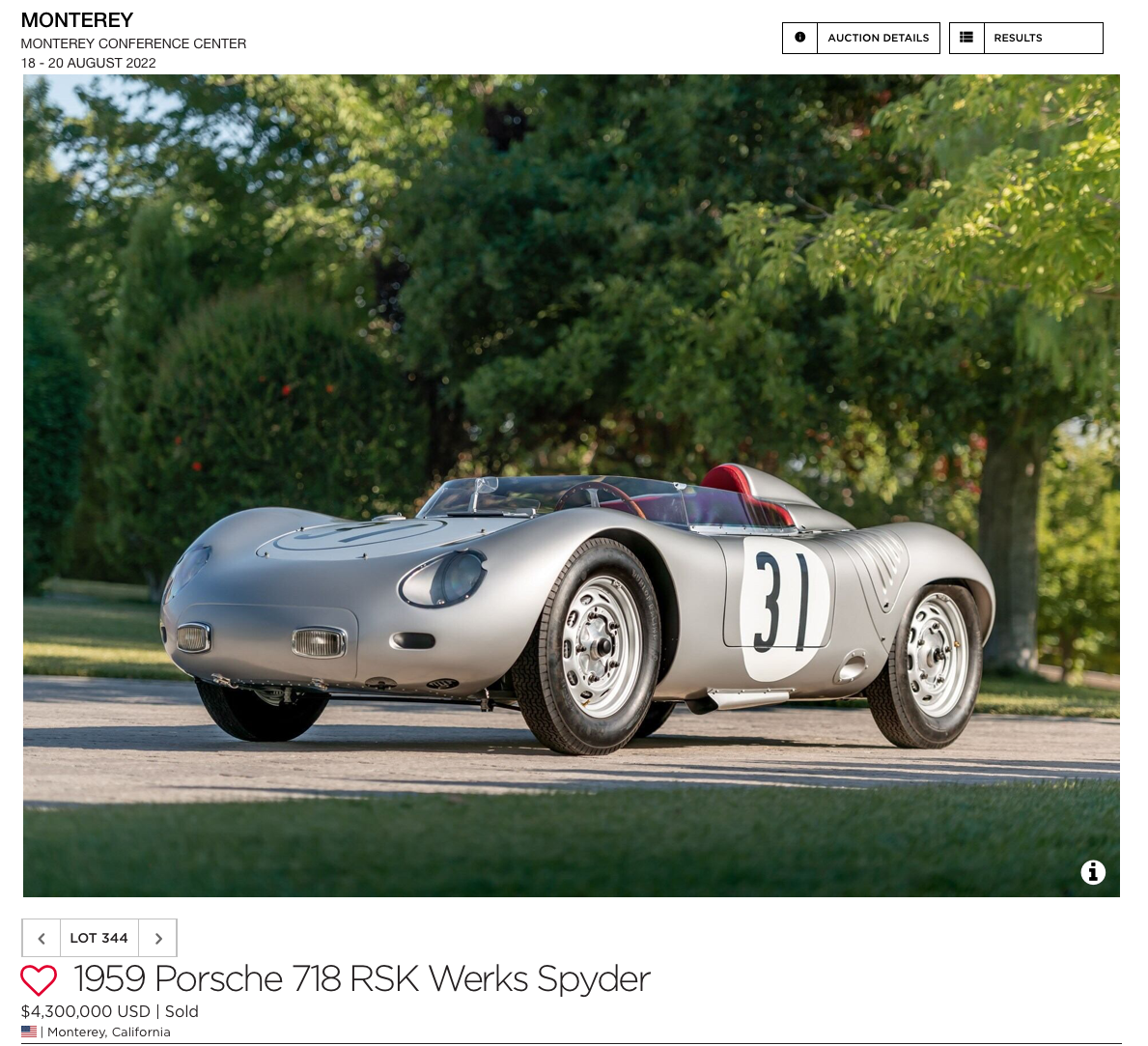

Broad Arrow's 1 of 500 La Ferrari sold for just under $4M, about the same price as a 1 of 10 Porsche built 718 RSK prototype with class wins at Le Mans and Sebring.

As artifacts, the 50's Porsche and Ferrari are far rarer and more important than the late model Supercars and Hypercars, but there are more younger collectors who resonate with the cars they grew up reading about.

One thing is for sure; the collector car market is in a very healthy state. Both live and on-line, more cars are trading for more money than ever before.

Lawrence Romanosky, Calgary, Canada

Lromanosky@me.com, 403-607-8625

Comments ()