Building Depreciation Curves: When To Buy And Sell

Part of my business is acting as a consultant and advising clients on what vehicle they should buy, or at least what should be on their short list. Cost of ownership occupies a significant portion of the discussions, as it is of prime importance for buyers of basic transportation and exotica alike. Understanding - and predicting - depreciation is the key to determining an accurate estimate of the cost of ownership. Servicing also plays a role, but this is easily quantified. Depreciation is a little more complex.

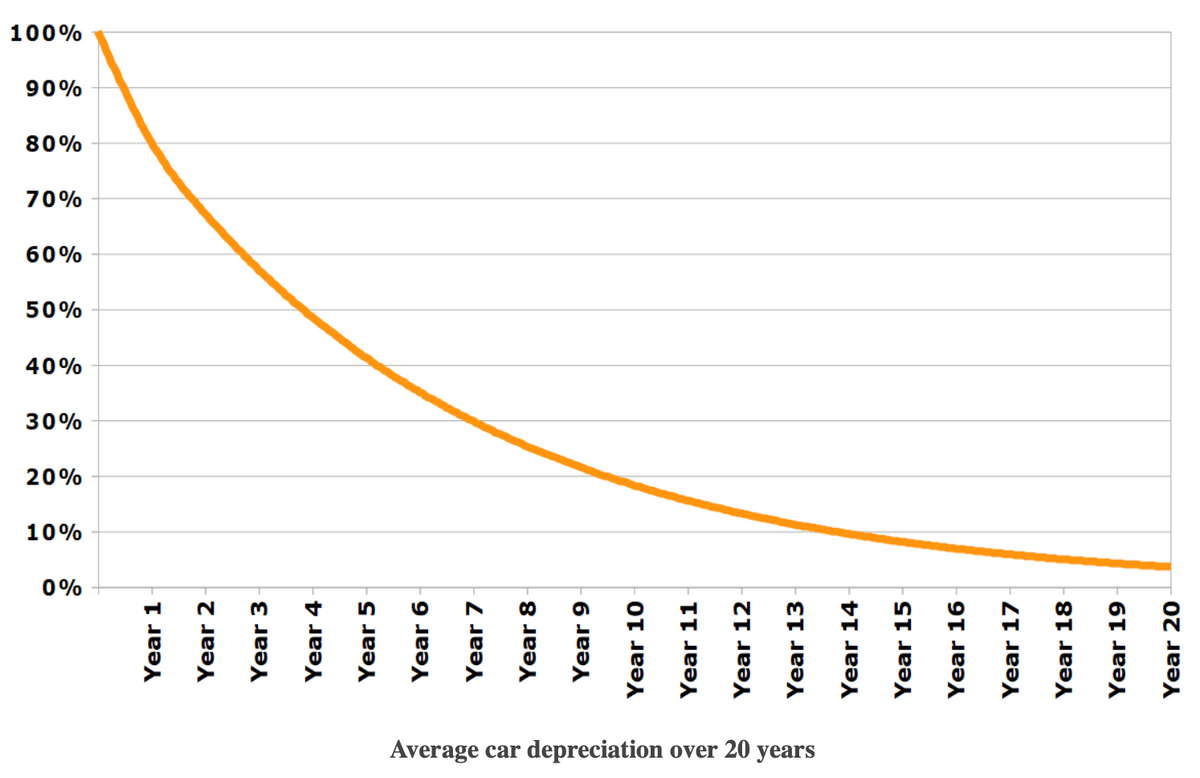

Most vehicles have a 20 year service life and will be scrapped at about that age or with 300,000km - whatever comes first. Historically, most vehicles lose 50% of their value every 3 or 4 years until about year 10 when the curve levels off.

What are the main factors which determine the slope of the depreciation curve?

- Price of the vehicle new - The price of a used vehicle is indexed to the cost of buying that vehicle new. This provides the used car buyer with a basis for their value decision. Tesla just reduced the prices of their entire line up $5k to $20k, and simultaneously devalued all the cars they had previously sold. A new Toyota Tundra is $20k+ more than outgoing model which helps the value of pre-2022 Tundras.

- New car availability - This is particularly relevant today, with the cascading set of supply chain issues brought on by COVID which have caused acute product shortages for many brands. If there are no new vehicles to buy, or there is a long and/or uncertain wait to order one, one and two year old models can still command MRSP or more. There is a two year wait for a Hyundai Ionic 5, and used examples are being advertised for $10k-$20k over MRSP. Buyers need to be careful; the minute these cars start appearing on dealer lots, the over-MRSP premium vaporizes, and the value falls back in line with a more realistic age/mileage depreciation curve.

- Vehicle complexity, servicing requirements and reliability - Used car buyers are looking to save money, otherwise they would be looking for a new car. The prospect of inconvenient expensive surprises and/or the high cost of dealer servicing will drive down the prices of complex luxury vehicles. An Audi, Porsche or Mercedes SUV may start out costing twice as much as a Toyota or a Kia, but within 7 or 8 years they will be worth the same amount. The reason is that it costs a lot less money to keep an 8 year old Toyota on the road relative to a Porsche.

- Supply - Greater numbers of similar vehicles for sale drive down the price. For some volume vehicles, there could be several hundred examples in your market at any one time. Unless your vehicle is in the best condition with the lowest mileage and price, you won't sell it.

- Demand - Certain types of vehicle, optional equipment, colours, trim levels etc. have a considerable affect on demand, and vary market to market. Higher end vehicles are more mobile as the $3k cost of shipping them across the country is a relatively small proportion of their value. If you have a RWD $20,000 sedan in Alberta, it is unlikely to find a buyer in the GTA. A Porsche GT3 could go anywhere, including out of the country. The desirability of a vehicle when it was new is most often an accurate indicator of its demand when it is a few years old. If the vehicle sat on the dealer's lot for two years because nobody wanted to buy it when it was new, chances are that no one will want it when it is used either.

Building the depreciation curve

The easiest way to predict the future value of a new vehicle is to look at that model's past i.e. what similar used vehicles are selling for. This is easier with something like a Honda Civic which hasn't materially changed in price or market segment over the years. Prices have risen for all cars, so take the used car price as a percentage of its new MRSP as a guide, and apply it to the new vehicle to predict its future value.

This is more difficult with a vehicle that is in a new segment, such as the current group of EVs. In that case you could compare it with similar vehicles from other brands. You might expect the retained value of a 5 year old Porsche Taycan to be similar to what a 5 year old Tesla Model S is today - again on a percentage of MRSP basis.

Residual values on leases give some information of what the leasing arm of the manufacture thinks the vehicles are going to be worth - though this is a wholesale or trade-in valuation. Manufacturers can be more or less conservative with their residual percentages. Some brands take the riskier option of increasing residuals to offer lower payment leases in a fight for market share. Others play it safe and keep the residuals low, making sure they will never be 'underwater' when a leased vehicle is returned. Looking at the residual differences between various models in a manufacturer's product line up can be illustrative: One vehicle or trim package could have a 50% residual over 3 years, and another has a 40% residual over the same time and mileage. Some leasing companies won't even residualize certain options - meaning that you have to pay 100% of the cost of the option over the lease term.

When you've done the research it is fairly simple to graph the results with Price on the Y axis, and Time on the X axis. Plug in values for years 3, 5, 7 and 10, then connect the dots with a nice curve. This gives you the cost of depreciation between any two time points.

Generalizations

It is probably not surprising that the most practical, reliable, safest and best rated vehicles hold the greatest percentage of their MRSP when used. I like to point out that these vehicles are the least likely to be discounted when they are new. The important advice here is that getting a 'deal' at a dealership and getting a discount relative to the MRSP does not often equate to a low cost of ownership. Conversely, paying full MRSP for the best car when new often yields the lowest cost of ownership as the same qualities that made the car sought after when new will still be there a few years down the road, giving you back a greater percentage of the purchase price. Also, this saves the trouble negotiating for what you think is a market correct price - just pay MRSP and take the car.

Generally speaking, the more expensive the car, the lower the percentage of value it will retain. This is especially true for 'individual' options and personal customization available with some luxury brands. These 'exclusive' options are expensive to buy, and by nature not going appeal to everybody. You can spend tens of thousands of dollars on a custom 'build', but you may not get much or anything back when it comes time to sell. That is why leasing companies may put a cap on the amount that they will residualize.

The above considerations apply to what are 'normal' passenger cars. Every decade there are a certain number of vehicles which represent the best of design, engineering and performance. These vehicles will be used sparingly and have a much longer service life than more utilitarian machines. Many will be worth restoring and kept in collections. For these vehicles - which include certain Porsche, Ferrari and other luxury sports cars - depreciation in the typical sense doesn't really apply. With very limited mileage, they are not being 'used up' over time, and their value is based on the larger collector car market. For many of these limited production vehicles, the lowest price they will ever sell for is their new car MRSP.

For those who want to buy a new high end vehicle, but can't justify the $30k or $40k first year deprecation, the solution is just to keep it longer. Over a 10 year period the cost of ownership becomes a lot more reasonable. In this case it makes sense to take your time, and custom order a 'special' vehicle that you will be happy with for a long time. I have many clients with 2o-year old luxury cars that still perform well, and provide them with a lot of satisfaction. Considering the movement to e-mobility, now isn't a bad time to order something special.

Lawrence Romanosky operates a specialty car brokerage business out of Calgary, Canada. He has 20+ years experience with the Aston Martin, Bentley, Ferrari, Maserati, Mercedes-Benz and Porsche brands, and a lifetime fooling around with classic cars.

Lromanosky@me.com 403-607-8625

Comments ()