Vehicle Depreciation: EV vs. ICE

The subject of the depreciation rates of EVs, compared to ICE vehicles, came up on a recent Podcast I was invited to join (with more on this later). I am reasonably bullish on EV long term value retention, but predicting this future depreciation is challenging.

Normally when looking at anticipated depreciation, I look to the past for historical data. When somebody asks what their 2024 BMW 3 Series will be worth in three years, I tell them to look at what a 2021 3 Series is worth today. This doesn’t work quite so well with EVs as many models are quite new, and the sales data we have from the last five years comes from one of the most tumultuous periods in automotive history.

Many of the new generation EVs were rushed to market before they were ready and had significant software issues. Many were rolled out very slowly because of COVID-related supply chain issues, creating a large backlog of orders. The shortage of vehicles created significant dealer mark-ups over MSRP. Some consumers were ordering EVs to flip for a quick profit. In addition to the variable dealer pricing, manufacturers responded with price increases and in some cases unprecedented price decreases. Depreciation was then heavily dependent on the starting and ending point - the same vehicle could experience price appreciation, zero depreciation and then significant depreciation all within one ownership cycle.

Some examples of vehicles that faced accelerated depreciation:

The Chevrolet Bolt was recalled because of the possibility of battery fires. The NHTSA advised not to park the car in a garage, beside your house or near any other structure. Chevrolet had to put a ‘Stop Sale’ on all Bolts, and eventually took the vehicle out of production. They may have replaced the batteries and updated the software, but having a vehicle go out of production because it caught on fire is not good for resale.

Tesla lowered the price of their Model S Plaid in Canada from $188,600 in 2021 to $124,990 in 2024 and lowered the Model 3 and Y prices three times in 2024. The Model Y Long Range had an MRSP of $85,000 in 2022, now it is $64,000. Price decreases like this haven’t been seen since Henry Ford lowered the price of the Model T over 100 years ago.

Fisker owners were delivered vehicles with glitchy software and without the features that they ordered, just before learning that the company was filling for bankruptcy and the remaining Fisker inventory was being sold off at 20% of MRSP. When over 3,000 new Fiskers that were sold for $USD 16,500 hit the market, this does not bode well for the SUV that you paid $CAD100k for. Not to mention the uncertainty of being able to keep the vehicle operational. A Fisker Ocean will have lost more than 50% of its value without even being driven. Similar to the Fisher Karmas that I sold in 2009…

Will this history repeat itself? Will people defer the purchase of an EV because they expect the price to go down in the future? Will the EV pricing stabilize with the reduction of supply chain issues and with the equalization of supply and demand? Recent studies have shown that EVs depreciate more quickly than ICE vehicles, but is the last five years representative of what will happen in the future?

My opinion on the matter is that the last 5 years of data are not particularly useful in predicting future EV values, and that that same forces that influence the shape of a vehicle’s depreciation curve affect both an ICE vehicle and EV equally and will result in similar depreciation rates. I think we can assume that the supply chain issues will mostly resolve themselves and that Manufacturers will adjust production to meet the demand for their products. With supply and demand in equilibrium I think we will see an end to dealer ‘market adjustments’, and big price changes from manufacturers.

In the first few years of ownership most vehicles experience the heaviest depreciation. Some, like limited edition sports cars or other specialty vehicles, can appreciate but that is the subject of another column. When a regular passenger car is driven off the lot it takes a significant step down in value. This is simply because buyers place a premium on getting something that is new, and getting to choose the colours and options that they want.

The rate of depreciation that a two or three year old vehicle faces is indexed to the cost and availability of a new one. This used buyer can normally afford both and needs to see a significant discount in order to forgo the experience of buying new. If the new model is impossible to get then the used one is worth more, sometimes even more than the MSRP. If there are heavy incentives on the dealer lots for a new vehicle, the used one is worth less. If there is a new model with more desirable features, the used one less. etc.

When the vehicle is out of warranty three or four years later, it is worth 40% to 50% less than when it was new. The buyer for this vehicle is generally not cross shopping it with a new vehicle. They are generally cost conscious and are looking for a vehicle that will be reliable with predictable operating costs and a low overall cost of ownership. Most want a reliable vehicle that won’t give them inconvenient surprises when they are trying to get to work or their kids to soccer. They certainly don’t want large unexpected repair bills. This means the expected running costs and reliability materially affect the depreciation rate in the post-warranty period of a vehicle's service life. It explains why Toyotas and Hondas generally have the highest resale values.

I see these forces acting more or less equally on ICE vs. EVs. Not that there isn’t significant differences in depreciation between vehicles, but I would expect an ICE vehicle and an EV from the same brand and/or market segment to have similar depreciation curves. When I look at the used prices of pairings such as the Porsche Panamera/Porsche Tacan, Tesla Model 3/BMW 3 Series, Tesla Model S/Mercedes S Class, Mini Cooper/Mini Electric, Smart Fortwo/Smart Electric etc. I don’t see any material differences.

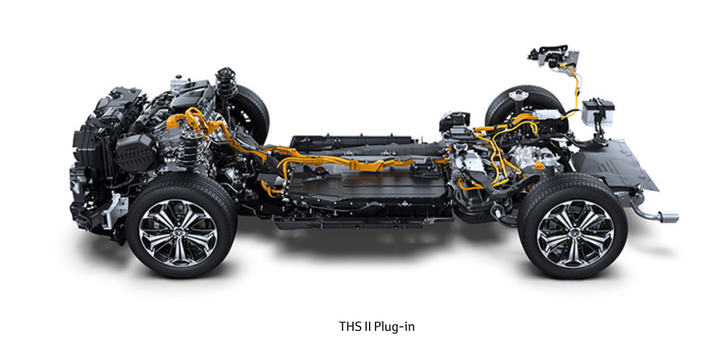

The one thing that could drastically affect the depreciation of EVs is the fear of having to replace the battery pack, which could cost tens of thousands of dollars and might even write off the vehicle. These fears appear to be unfounded, as we are now seeing EV’s with 300,000 and 400,000km with their original batteries suffering minimal degradation. A 5% loss of capacity every 100,000km appears to be a reasonable expectation - at least for the large battery packs in the new-generation EVs which have advanced thermal management controls. Also, battery health can be easily checked with on-board diagnostics. Batteries degrade in a mostly linear fashion over time, so the risk of a sudden catastrophic event would be extremely rare. There are also companies offering extended warranties on EV battery packs for those who don’t want to take any chances.

If anything, I would give the depreciation edge to EVs as the lower running and maintenance costs should make the vehicle more attractive to the value conscious used car purchaser. Also, given that there are very few new EVs under $50,000, there are undoubtably many consumers who want an electric vehicle but are waiting for the price to come down.

-Lawrence Romanosky

New Arrival!

Comments ()